In today’s rapidly evolving financial landscape, secure cash management is of paramount importance, especially for industries subject to stringent regulations such as Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) compliance. These regulations are designed to combat financial crimes, including money laundering and terrorist financing, and require businesses to implement robust cash management practices to ensure transparency, accountability, and security. We’re addressing some of the most common challenges faced by highly regulated industries in managing cash, particularly focusing on AML/BSA compliance, and exploring potential solutions to address these challenges.

The Importance of AML/BSA Compliance in Cash Management:

AML and BSA regulations were established to protect the integrity of the financial system by preventing illegal activities such as money laundering. Highly regulated industries, including financial institutions, casinos, and money services businesses, are mandated to implement stringent measures to identify and report suspicious activities involving cash transactions. These measures are crucial for maintaining the security and stability of the economy while upholding the reputation of these industries.

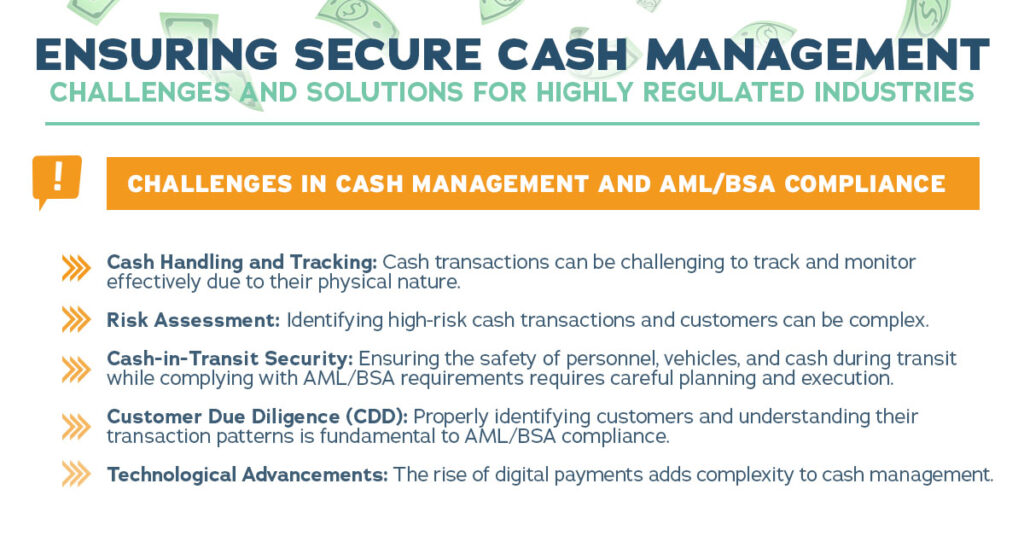

Challenges in Cash Management and AML/BSA Compliance

Cash Handling and Tracking

Cash transactions can be challenging to track and monitor effectively due to their physical nature. Ensuring accurate cash counting, recording, and reconciliation is crucial to prevent discrepancies that could raise suspicions of financial misconduct.

Risk Assessment

Identifying high-risk cash transactions and customers can be complex. Developing a robust risk assessment framework is essential to allocate resources effectively to the transactions and individuals that pose the greatest risk.

Cash-in-Transit Security

Businesses that transport cash, known in the industry as cash-in-transit (CIT), face unique challenges. Ensuring the safety of personnel, vehicles, and cash during transit while complying with AML/BSA requirements requires careful planning and execution.

Customer Due Diligence (CDD)

Properly identifying customers and understanding their transaction patterns is fundamental to AML/BSA compliance. This process, known as Customer Due Diligence, can be challenging, especially when dealing with complex ownership structures or clients who attempt to hide their identities.

Technological Advancements

The rise of digital payments, even for highly regulated industries, adds complexity to cash management. These companies must adapt their AML/BSA procedures to encompass emerging technologies effectively.

Secure Storage of Company Records

While many business owners think about the secure storage of cash, they fail to properly store crucial business documents regarding their cash management operations.

Solutions to Address AML/BSA Challenges

Automated Cash Management Systems

Investing in technology-driven cash management systems can streamline cash handling processes, reducing the risk of errors and enhancing transparency. These systems can automate cash counting, sorting, and reconciliation, minimizing human intervention and error.

Advanced Data Analytics

Leveraging data analytics tools can help identify unusual patterns in cash transactions, facilitating the early detection of potential suspicious activities. Machine learning algorithms can continuously learn from transaction data to improve accuracy over time.

CIT Security Measures

Your cash-in-transit provider should be utilizing state-of-the-art security measures, including real-time GPS tracking of vehicles, secure communication channels, and personnel training for emergency situations. Having transparency into the movement of your cash is critical once it leaves your place of business.

Enhanced Customer Due Diligence

Implementing robust customer identification and verification processes, as well as ongoing monitoring of customer transactions, can help identify and prevent unauthorized or suspicious activities.

Secure Storage of Company Records

Utilizing a secure, off-site storage facility is an ideal way for businesses to safeguard sensitive data while also satisfying AML/BSA regulations relating to the tracking of cash management operations.

Protecting Your Cash from Start to Finish

Finding the right partner to support your business in ensuring secure cash management can be the difference between maintaining compliance and dealing with hefty violations. OSS is the industry-leading expert in risk management solutions, including financial regulation and compliance, as well as critical cash management services such as:

- Cash-In-Transit Solutions

- Secure Short-term Vaulting

- ATM & ITM Cash Management

- Smart Safe Programs

- Compliance Training & more.

Ready to learn how OSS can help you securely optimize your cash management operations while remaining compliant? Speak with one of our experts.